Live Gold Pricing

Track current gold bar prices with market data updated on page load.

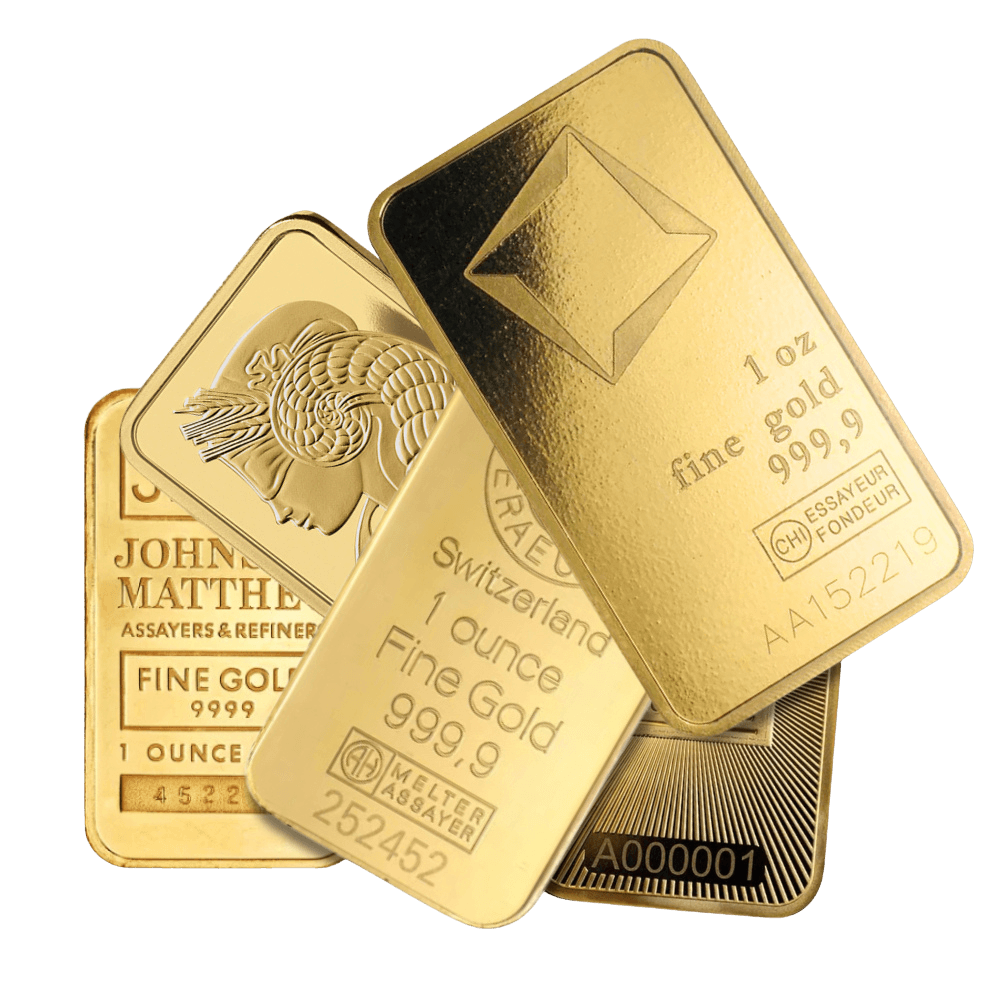

Why Choose 1 oz Gold Bars?

The 1 oz format balances accessibility with reasonable premiums, making it a practical choice for most individual investors.

Accessible Price Point

Unlike larger bars that require significant capital, 1 oz bars allow you to start building a gold position with a manageable investment. Add to your holdings gradually over time as your budget allows.

Strong Liquidity

The 1 oz size has the largest buyer pool in the retail gold market. When you decide to sell, dealers readily purchase these bars. The broad market makes finding a buyer straightforward compared to larger or more obscure sizes.

Flexible Ownership

Own multiple 1 oz bars rather than one large bar, and you can sell portions of your holdings as needed. This flexibility helps with partial liquidation, gifting, or adjusting your portfolio over time.

Who Buys 1 oz Gold Bars?

The 1 oz format appeals to a wide range of buyers, from first-time investors to experienced collectors.

First-Time Gold Buyers

Investors new to physical gold often start with 1 oz bars because the entry cost is manageable and the format is easy to understand and store.

Regular Accumulators

Many investors buy one bar per month or quarter, dollar-cost averaging into gold over time. The 1 oz size fits this approach well.

Gift Givers

Gold bars make meaningful gifts for graduations, weddings, or milestones. The 1 oz size is substantial enough to be impressive while remaining affordable.

Comparing Bar Sizes

Understanding the trade-offs between bar sizes helps you choose the right format for your goals.

| Feature | 1 oz Bar | 10 oz Bar | 1 Kilo Bar |

|---|---|---|---|

| Typical Premium | 3-8% | 2-4% | 1.5-3% |

| Approximate Cost | |||

| Liquidity | Highest | Good | Limited |

| Flexibility | ★★★★★ | ★★★☆☆ | ★★☆☆☆ |

| Capital Required | Low | Moderate | High |

| Best For | Beginners, Flexibility | Balanced approach | Serious investors |

Important Considerations

Before buying 1 oz gold bars, understand these practical factors.

Premium Costs

1 oz bars carry higher premiums (3-8%) compared to larger bars. This is the trade-off for liquidity and flexibility. If premium efficiency is your top priority, larger bars may be more suitable.

Note: You pay the premium when buying and typically sell at or below spot, so the gold price must rise enough to overcome this spread.

Authentication

Buy from reputable dealers and choose bars from recognized refiners (PAMP, Valcambi, Perth Mint, etc.). Bars with assay cards and serial numbers provide documentation that supports authenticity and resale.

Note: If a price seems too good, be cautious. Counterfeit risk exists, especially from unknown sellers.

Storage Options

1 oz bars are compact and easy to store. A home safe, bank safe deposit box, or professional vault can all work. Consider insurance for your holdings regardless of storage method.

Note: Keep bars in their original packaging when possible to preserve condition and simplify future resale.

Selling Your Bars

When ready to sell, contact dealers for quotes. You will typically receive spot price minus a small spread (1-3%). Having original packaging and documentation can improve offers.

Note: Get quotes from multiple dealers to ensure competitive pricing when selling.

Questions & Answers

Common questions about 1 oz gold bars answered by our editorial team.

What is the actual weight of a 1 oz gold bar?

A 1 oz gold bar contains exactly one troy ounce of gold, which equals 31.1035 grams. This is the standard weight for retail gold bars and is the most common size purchased by individual investors.

Why do 1 oz gold bars have higher premiums than larger bars?

The 1 oz size has higher per-ounce premiums (typically 3-8% over spot) because manufacturing, packaging, and handling costs are spread across less gold content. Each bar requires individual minting, assaying, and packaging regardless of size. The trade-off is better liquidity and flexibility.

How much does a 1 oz gold bar cost?

A 1 oz gold bar costs the current gold spot price plus a dealer premium, typically ranging from 3-8% depending on the refiner and market conditions. The exact price changes continuously with the gold market. Check our live pricing widget for current values.

Are 1 oz gold bars easy to sell?

Yes, 1 oz gold bars are among the most liquid gold products available. The size has broad appeal to both individual buyers and dealers, creating a large market. Most established dealers readily purchase 1 oz bars from recognized refiners. The wide buyer pool generally makes selling straightforward.

How do I store 1 oz gold bars safely?

The compact size of 1 oz bars makes storage flexible. Common options include a home safe, bank safe deposit box, or professional vault storage. Consider insurance for your holdings regardless of storage method. Keep bars in their original packaging to preserve condition and documentation for future resale.

Ready to Learn More?

Explore current gold prices, browse our educational resources, or check our buying guide to find reputable dealers.